Let’s face it: managing money isn’t something we’re born knowing – it’s something we learn (or at least, we should). Yet for many adults, financial literacy wasn’t exactly a highlight of school. From navigating mortgages to figuring out how to budget for monthly bills, too many people feel unprepared for life’s financial realities.

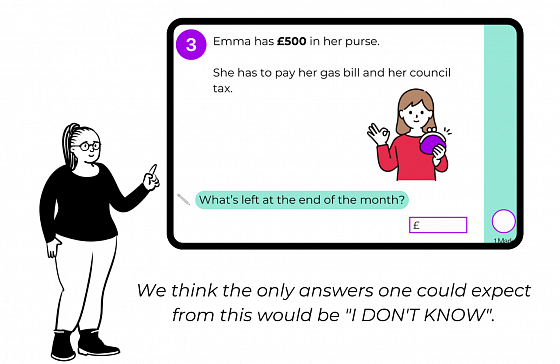

How many times have you heard someone joke, “I’m so glad I know Pythagoras’ theorem, but that won’t help me get a mortgage!”? It’s a classic, even though hilariously my mum enjoys mentioning whenever possible that she used the power of a2 + b2 = c2 to help build our garage roof. Either way, these internet trends remind us how far we've come in education and how teachers like yourselves strive to prepare our young people for what is beyond the school gates.

Where Does Financial Education Fit Into the UK Curriculum?

Financial literacy is covered under several subjects in the UK national curriculum. Here’s where you’ll find it:

- Maths: At Key Stage 1, children are introduced to money through counting coins and solving practical problems involving money. As students progress to Key Stage 3, they learn about percentages, interest, and loans – offering an ideal chance to link maths to real-world money scenarios.

- PSHE (Personal, Social, Health and Economic Education): The Department for Education specifies that PSHE lessons should include financial education topics, such as managing money, budgeting, and understanding credit.

- Citizenship (Secondary): At Key Stage 3 and 4, students are taught about the functions of money, taxation, and managing personal finances. They also explore how financial decisions affect individuals and society (National Curriculum for Citizenship).

These subjects provide a foundation for financial literacy, but the challenge lies in making lessons engaging, relatable, and practical for students.

Making Money Lessons Relatable

Financial literacy lessons work best when they connect to students’ everyday lives. Here are some practical ideas for making money education relevant and engaging:

Primary School:

- Make Saving Fun: Introduce challenges like the “1p Saving Challenge,” where pupils save 1p on day one, 2p on day two, and so on. By the end of the year, they’ll have saved £667.95 – a fun and simple way to demonstrate how small actions add up over time.

- Needs vs Wants: Help pupils identify “needs” (essentials like food or clothes) versus “wants” (luxuries like toys or sweets). This activity encourages prioritisation and thoughtful spending.

- Interactive Activities: Use coins for hands-on activities like identifying money, calculating totals, and making change. Role-play as shopkeepers or shoppers to make lessons come alive.

Secondary School:

- Banking Basics: Teach students how to open a bank account, use a debit card, and understand overdrafts. Did you know that some youth bank accounts offer interest? These lessons build confidence in managing money for the first time.

- Budgeting Exercises: Have students create a budget for something they want, like saving for a concert. Include fixed costs (e.g., savings) and variable expenses (e.g., snacks) to highlight the importance of planning.

- Understanding Interest Rates: Explain how savings accounts grow through compound interest – and how borrowing can result in paying back more than the initial loan at moneyhelper.org.uk.

Breaking the Stigma Around Money

A study found that four in five people avoid discussing their finances with someone. Feelings such as embarrassment, fear of judgement, or not wanting to be a burden often prevent people from seeking advice about money. These barriers can lead to poor financial decisions or stress. Normalising money conversations in schools helps break this cycle and builds students’ confidence.

How to Normalise Money Talk:

- Encourage Discussions: Pose relatable questions like, “What would you save for first: a car or a holiday?” or “How do you feel about asking for financial advice?”

- Address Financial Emotions: Show students that money management isn’t just practical – it’s also emotional. Discussions about pride in saving or anxiety about spending help normalise these feelings.

Free Resources to Support Financial Education

If you’re looking for tools to bring financial literacy into your classroom, these free resources are a great place to start:

- EconEdLink: Free lesson plans covering personal finance and economics, tailored for all ages.

- MoneySense by NatWest: Interactive tools and activities to teach financial capability.

- Financial Capability Strategy for the UK: Research and practical resources to improve financial education.

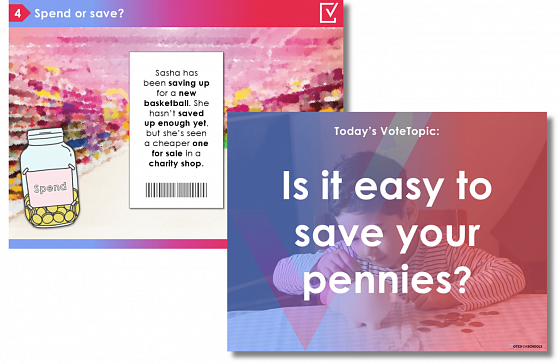

- VotesforSchools: Ready-made assemblies and lessons that link financial literacy to real-world situations.

Why Financial Education Matters

Teaching about money in schools is about much more than solving maths problems and using calculators. It’s about preparing students for real life – from understanding their first payslip to asking the bank for their first mortgage.

By embedding financial literacy into lessons, you’re not just meeting curriculum requirements; you’re providing the next generation with practical skills they’ll use every day and giving them power and knowledge to take control of their own finances. Let’s make sure they leave school saying, “I learnt that in class!”

This article was written by our intern Emma. She has a degree in languages and has lived abroad teaching English as a second language. She is passionate about topics that give young people the skills needed for life beyond the school gates (things she wished she'd learnt in school herself!)